I am an Entrepreneur who was born and raised in the Mohawk Valley of Central New York State. I believe the Mohawk Valley has all the ingredients to nurture and produce successful Startup companies. Martin Babinec of Upstate Venture Connect once said, “The Mohawk Valley can be the Silicon Valley of the East Coast.”1 I believe the Mohawk Valley Entrepreneurial ecosystem is an “emerging”2 Startup Ecosystem. In the following paragraphs I will describe this Ecosystem’s environment, the Verticals3 that exist here to support Startups, and name some specific Startup competitions and Startup companies based in the Mohawk Valley.

MOHAWK VALLEY STARTUP ECOSYSTEM ENVIRONMENT:

The Mohawk Valley region of New York State is the area surrounding the Mohawk River, sandwiched between the Adirondack Mountains to the north and Catskill Mountains to the south.4 The main cities and villages of the Mohawk Valley are: Utica, Rome, Sherrill, Cooperstown, Oneonta, Schenectady, Scotia, Rotterdam, Herkimer, Little Falls, and Amsterdam.

A Demographic population of 30% plus between 20 and 35 years old, is an age range particularly likely to engage in entrepreneurship.5 The Mohawk Valley has a population of 27% between the age of 25 to 40.6 However, this number is improved by the fact that there are Twenty plus Colleges and Universities located in and around the Mohawk Valley region including several notables like: Cornell, Syracuse, Colgate, Clarkson, Hamilton, Albany, Utica, SUNY Poly, and the Mohawk Valley Community College.

The area is also supported by easy access to several forms of transportation. The Valley includes four Regional County Airports: Oneida, Schenectady, Frankfort-Highland, and Fulton Airports. Also, two International Airports, Syracuse and Albany, are both located within a two hours drive of the heart of the Mohawk Valley. The Amtrak Train system cuts straight thru the Valley from East to West, with stops in Syracuse, Rome, Utica, Amsterdam, Schenectady, Albany, and on to Boston or New York. Finally, the New York State Thruway, a major Highway, also cuts straight thru the Valley from East to West providing an easy drive of four hours or less to New York City and Boston.

The major Arts, Culture, and Restaurant scenes are located in the Cities of Utica, Rome, Syracuse, Schenectady, and Albany. The Valley includes attractions like the Baseball Hall of Fame in Cooperstown, Fort Stanwix National Monument in Rome, Museum of Innovation & Science and the Symphony Orchestra in Schenectady, and the Famous Erie Canal. The Adirondack mountains give easy access to world class hunting, fishing, boating, and numerous winter sports mountains. The Lake Placid Winter Olympic village and venues are located only a few hours drive to the north.

Many large Companies and Corporations are scattered throughout the Mohawk Valley to include: General Electric, Niagara Mohawk, Air Force Research Lab (Rome Lab), CONMED, Assured Information Security, MV Applied Technology, Power & Composite Technologies, Beechnut, Fortitech, Applied Robotics, Super Power, Knolls Atomic Power Lab, Bassett Healthcare Network, Turning Stone Casino Resort, Matt’s Brewing Co., Herkimer Diamonds, and Remington Arms.

The New York State Government is also creating a very attractive and supportive environment for Tech Startup companies with the NY State Innovation Venture Capital Fund of $50M made available to support and attract new high-growth businesses and the Startup New York program making 10 year Tax Free zones available for qualified New Tech Startup companies.

VERTICALS IN THE MOHAWK VALLEY STARTUP ECOSYSTEM:

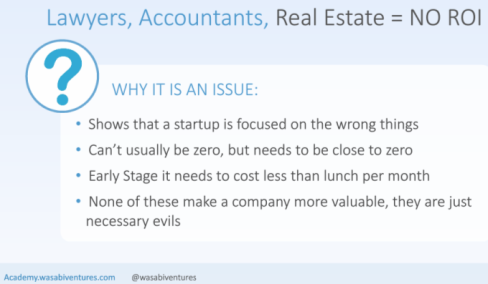

The Mohawk Valley is ripe with support platforms that will help facilitate the flow of technology, entrepreneurs, and venture capital. These include for profit and non-profit companies that work to attract, fund, and support Startup Business Ventures. Following is a list of these Startup Verticals with a Hyperlink to each: ATTRACT: NY Furnace Accelerator, Mohawk Valley EDGE, Upstate Venture Connect, Griffiss Institute, Air Force Research Lab (Rome Labs), FUND$: Mohawk Valley Entrepreneurs, Upstate Venture Assoc. of NY, Speed Capital Fund of CNY, RAND Capital Fund, Centerstate Corporation for Economic Opportunity, SUPPORT: NYSTEC, CYBER NY Alliance, Startup Strategy Group, Wasabi Ventures Academy, and thINCubator.

MOHAWK VALLEY STARTUP COMPETITIONS AND COMPANIES:

In 2014 the Mohawk Valley was host to two Startup Competitions, the Griffiss Institute Commercialization Academy and the NY Furnace Accelerator . These two competitions challenged Teams to develop business plans to transfer Air Force Research Lab Technologies to the Civilian Commercial Marketplace. The two competitions produced 10 New Startups for the Mohawk Valley Ecosystem. Four of these Startup businesses are listed here with a link to review their Business ideas: Clamp, LiLo, Sky Tube Live, and RRIDD.

EMERGING ECOSYTEM CONCLUSION:

The Mohawk Valley Startup Ecosystem is “Emerging.” This Startup environment which includes multiple colleges and Universities, easy Airport, Train, and Highway access, multiple supporting Verticals and Startup programs, and a Demographic age group of approximately 20-35 years old at nearly 30%, indicates to me that the Mohawk Valley is poised for rapid Startup business growth. The Mohawk Valley has the support systems needed for Startup success and those systems have the communication platforms, mentors, and cheerleaders needed to connect Entrepreneurs with Investors and sponsors. The Mohawk Valley is the next Silicon Valley, come and Startup here.

ENDNOTES:

- http://www.babinec.com/

- http://www.abell.org/sites/default/files/publications/CD-BaltoBostonEntreEcosys813.pdf , p. 4.

- http://smallbusiness.chron.com/verticals-business-26157.html , What Are ‘Verticals’ in Business?,by Tanya Robertson, Demand Media.

- Mohawk Valley. Wikipedia

- http://www.abell.org/sites/default/files/publications/CD-BaltoBostonEntreEcosys813.pdf, Learning from Boston: Implications for Baltimore from Comparing the Entrepreneurial Ecosystems of Baltimore and Boston, by Sean Pool and Matt Van Itallie.

- Counties: Schenectady, Montgomery, Fulton, Herkimer, Oneida, Otsego. See Demographics.

Chris Niles, LtCol(Ret), USAF

Believe it!